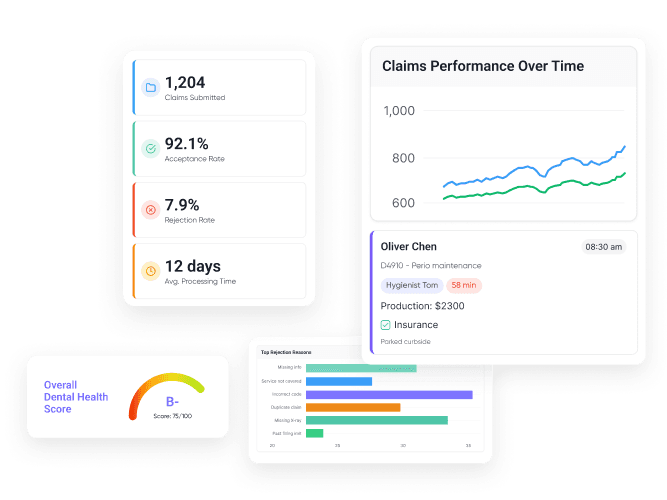

Achieve 98% First-Pass Acceptance With Forensic Scrubbing

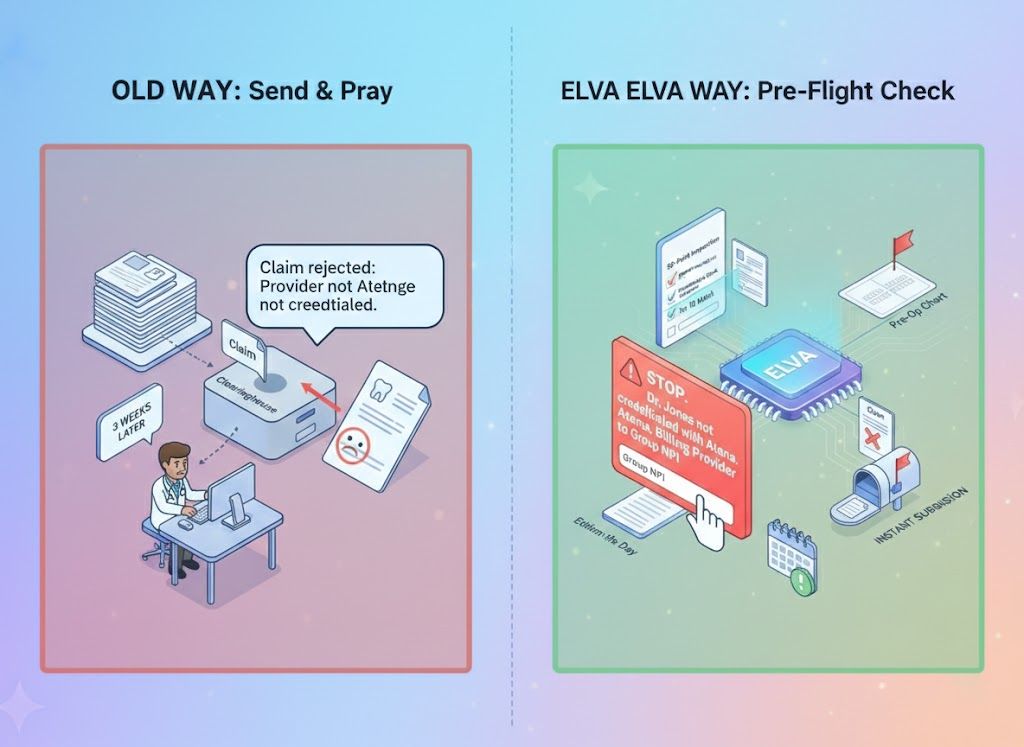

Most clearinghouses only check for missing zip codes. Elva performs a forensic audit on every claim. It checks for Anatomical Logic (e.g., "Occlusal" on an anterior tooth), Provider Credentialing mismatches, and Bundling Risks before you hit send, ensuring your claims are clean, compliant, and paid on the first attempt.

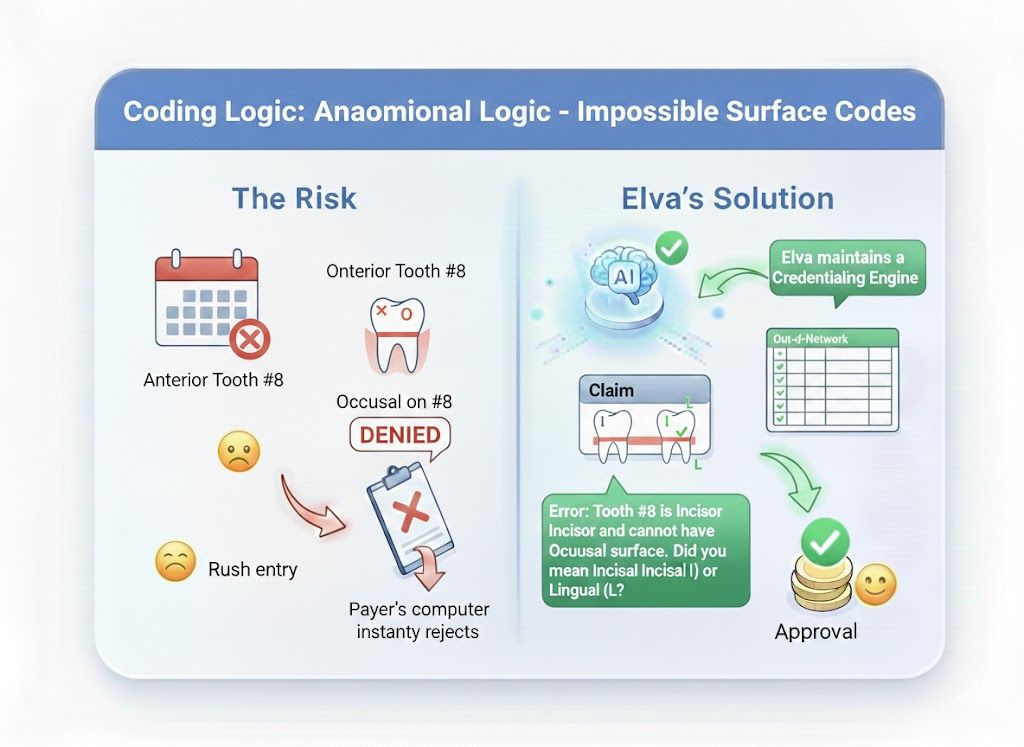

Anatomical Logic Engine

Flags impossible coding combinations, like billing a "Distal" surface on a wisdom tooth or "Occlusal" on an incisor.

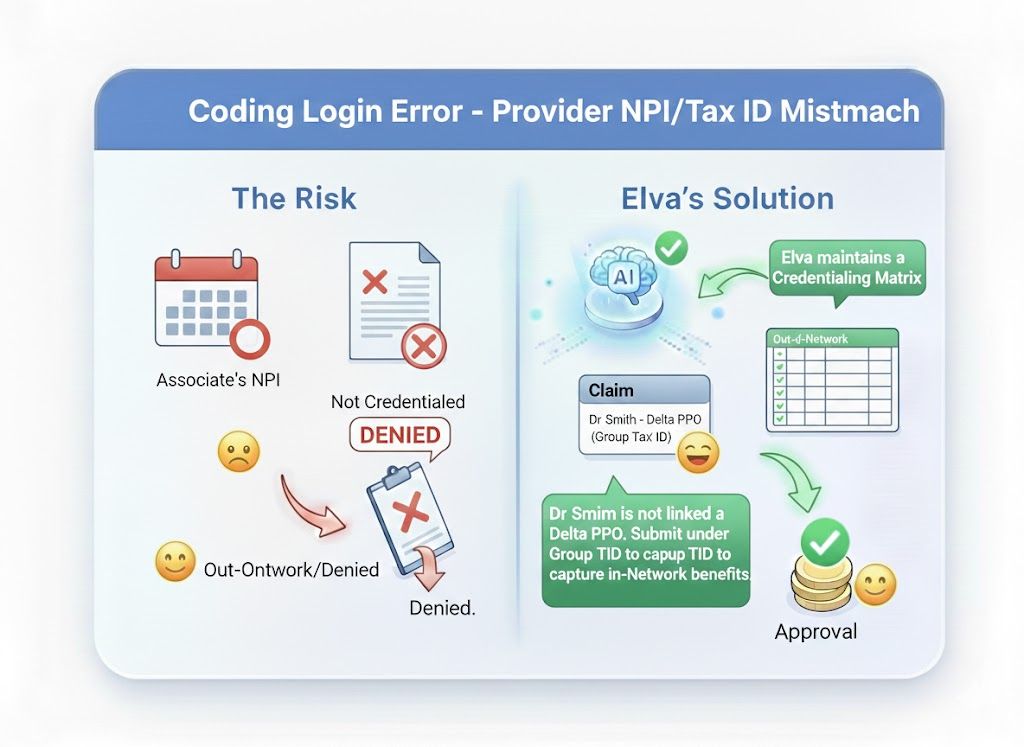

Credentialing Guard

Prevents "Out-of-Network" processing by verifying the Rendering Provider is linked to the correct Tax ID/NPI for that specific payer.

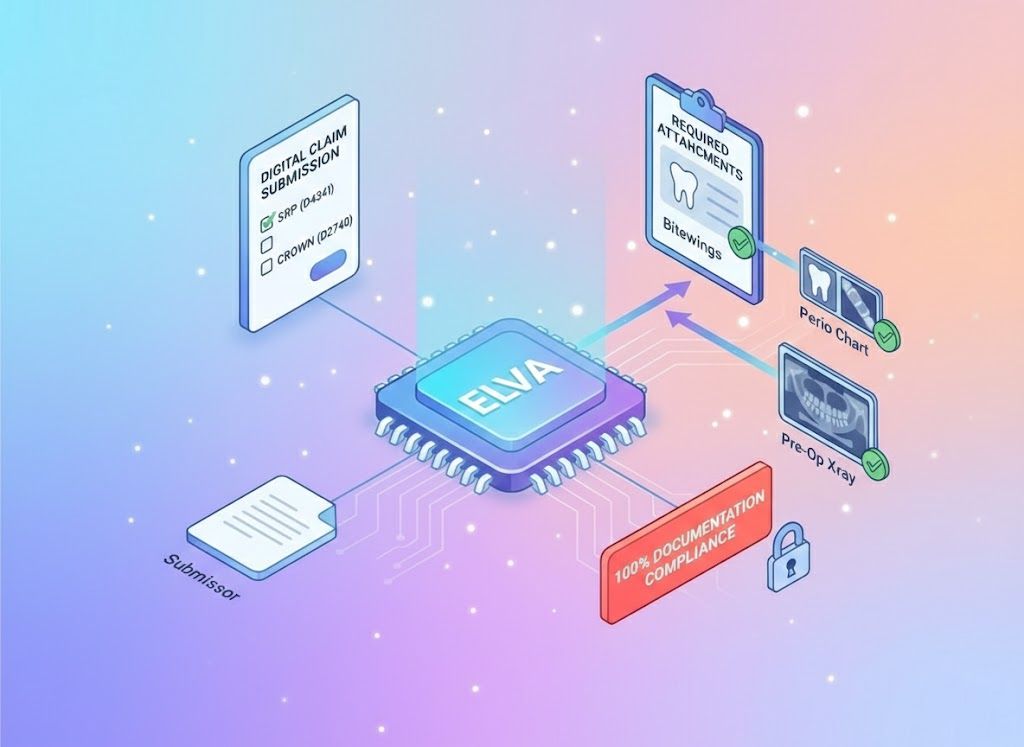

Attachment Automator

Automatically attaches the required Perio Chart for SRP or Pre-Op X-ray for Crowns, based on payer-specific rules.

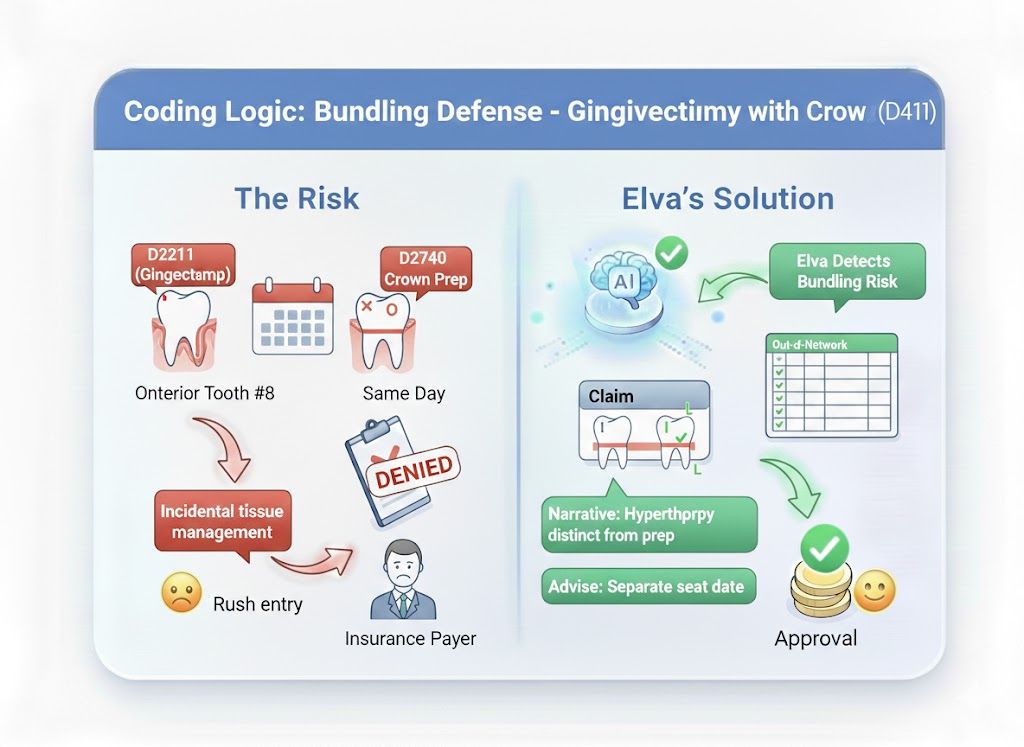

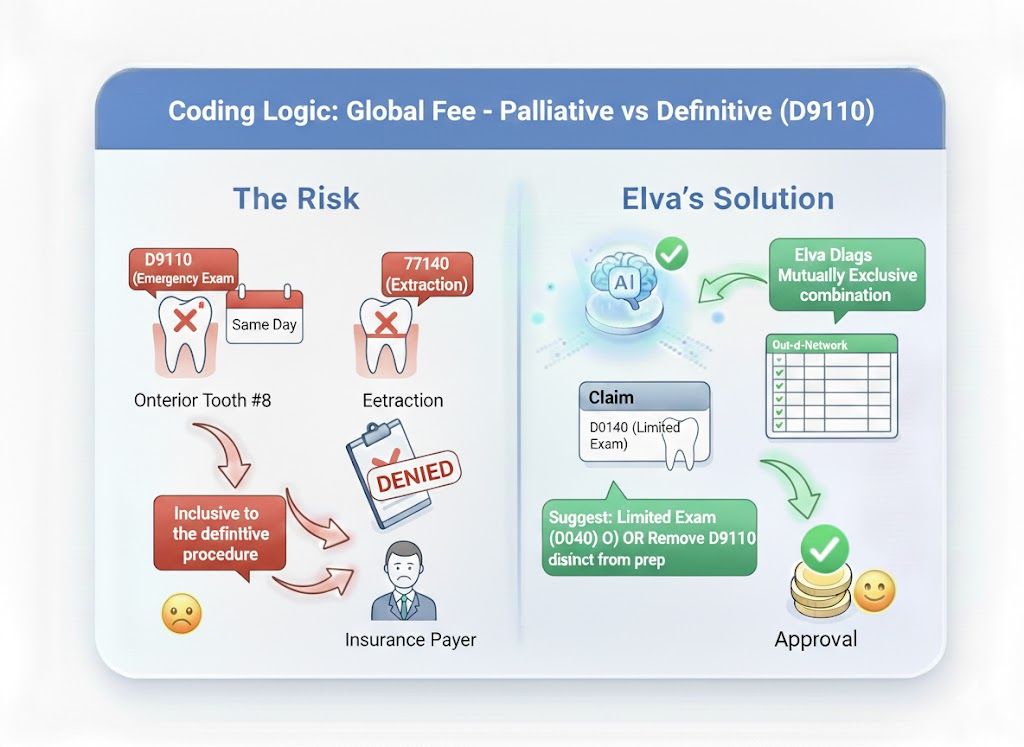

Bundling Predictor

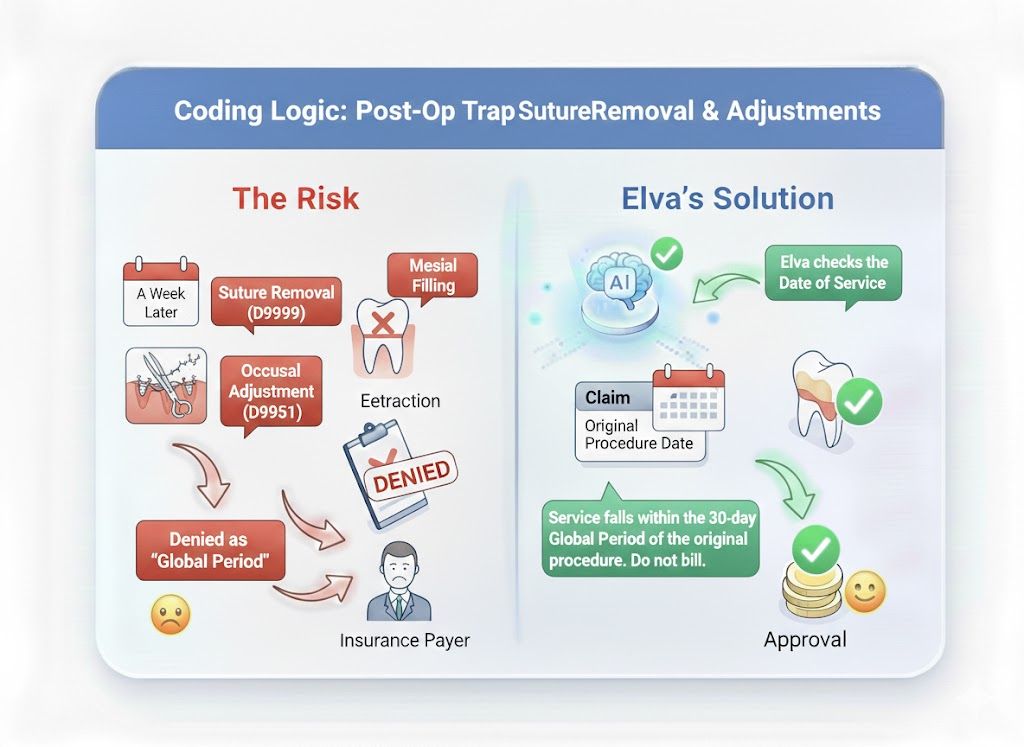

Identifies code combinations (like D9110 + Extraction) that will trigger an automatic denial and prompts you to fix them.

"Send & Pray" vs. Forensic Validation

The Old Way (Clearinghouse Basics): You hit "Submit" and hope for the best. The clearinghouse checks if the boxes are filled, but not if the data makes sense. You find out 3 weeks later that the claim was rejected because "Provider is not credentialed." The Elva Way (Pre-Flight Check): Elva runs a 50-point inspection. It warns you: "STOP. Dr. Jones is not credentialed with Aetna under this Tax ID. Change the Billing Provider to the Group NPI to ensure payment." You fix it instantly, preventing a month-long delay.

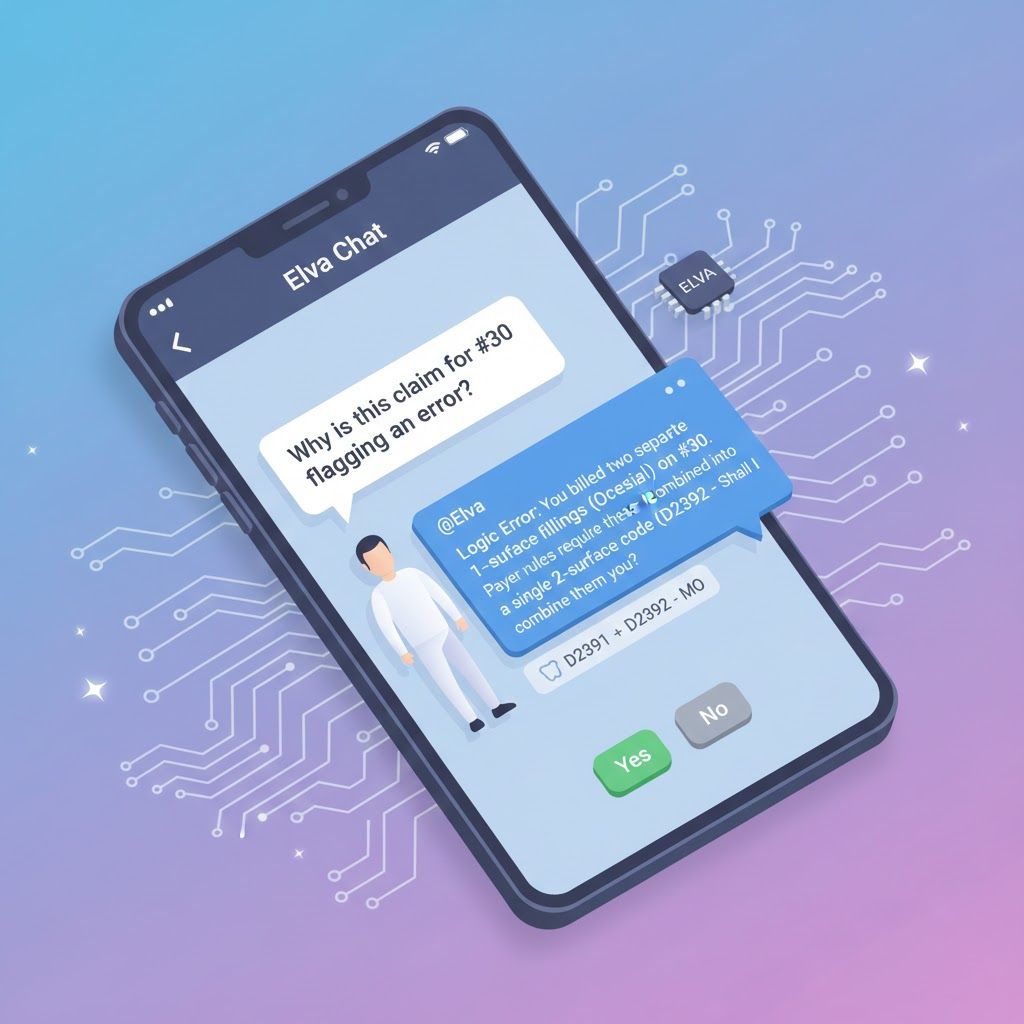

Don't memorize the rulebook. Just ask.

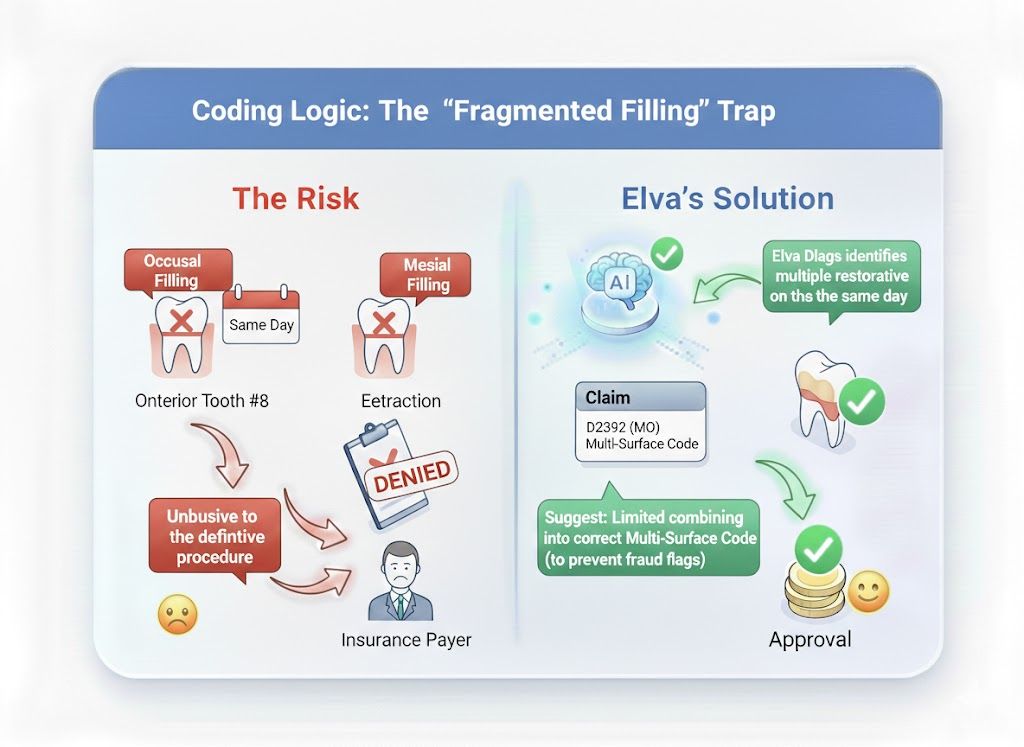

Your billing team can ask Elva to explain why a claim might fail before sending it. Biller: "Why is this claim for #30 flagging an error?" @Elva: "Logic Error: You billed two separate 1-surface fillings (Occlusal + Mesial) on #30. Payer rules require these be combined into a single 2-surface code (D2392 - MO). Shall I combine them for you?"

Scrubbing That Goes Beyond "Missing Zip Code"

Standard scrubbers miss the logic errors that cause 30% of denials. Elva reads the clinical reality of the claim, catching "Mutually Exclusive" codes and "Global Fee" violations that human billers overlook.

Automated Claim Sanitation

Elva acts as your firewall, ensuring that only "Perfect Claims" ever reach the insurance company.

Administrative "Spell Check"

Daily "Clean Claims" Batching

Attachment Enforcement

Ledger vs. Note Audit

The "Logic Check" Protection Layer

Elva validates your claims against the same strict algorithms used by insurance adjudicators, catching these specific logic errors before they leave your server.

Send Clean Claims Every Time

Stop fixing rejections 30 days later. Scrub your claims with the AI that knows the anatomical and administrative rules better than the adjuster.

Schedule a Demo